Running a small business in the UK means juggling many tasks. Keeping track of invoices, ensuring timely payments, and maintaining accurate financial records can be a significant challenge. The right invoicing software can transform this process, saving you time, reducing errors, and improving your cash flow.

We understand the unique needs of UK small businesses. From managing VAT to dealing with diverse client payment preferences, choosing the right tool is crucial. In this guide, we explore some of the top invoicing software options available, helping you make an informed decision for your business.

Why Reliable Invoicing Software is Essential for UK Small Businesses

In today’s fast-paced business world, efficiency is key. Manual invoicing can be time-consuming and prone to human error, which can lead to payment delays and compliance issues. Digital invoicing solutions offer a streamlined approach.

They automate repetitive tasks, provide professional-looking documents, and often integrate with other accounting tools. This not only boosts productivity but also ensures your invoices are accurate and meet UK regulatory standards. Investing in good software is an investment in your business’s financial health.

Exploring Essential Invoicing Platforms for UK Businesses

Here, we highlight some of the leading invoicing solutions, detailing what makes them suitable for small businesses across the UK. We have carefully selected tools that offer a balance of features, ease of use, and value.

1. Cordlo

Cordlo stands out as a comprehensive business management, estimation, and invoicing platform. It’s designed to simplify how businesses prepare quotes, issue invoices, collect payments, and stay compliant. We built Cordlo to centralize the full commercial workflow, making it a true financial operating system.

Cordlo helps eliminate administrative friction by providing a unified system for pricing, client approvals, billing, and payment tracking. For UK businesses, its compliance layer is particularly beneficial, handling invoice validation and regulatory metadata. You can also explore our flexible pricing plans to find a fit for your business.

2. Xero

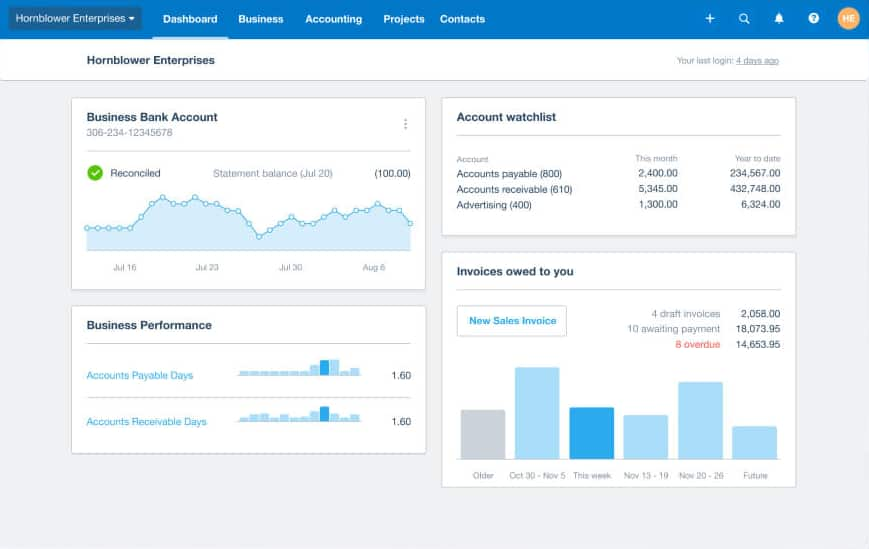

Xero is a popular cloud-based accounting software widely used by UK small businesses. It offers robust invoicing features, including recurring invoices, online payment options, and professional templates. Xero also integrates with hundreds of third-party apps, making it a versatile choice for growing companies.

Its dashboard provides a clear overview of your financial health, helping you keep track of money in and out. Xero’s user-friendly interface makes it accessible even for those new to accounting software. For more insights into professional documentation, you might find our article on what a professional invoice looks like helpful.

3. QuickBooks Online

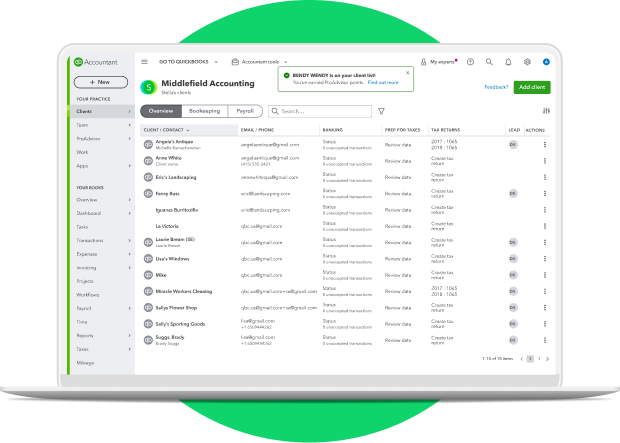

QuickBooks Online is another industry giant, offering a powerful suite of tools for invoicing, bookkeeping, and tax management. It’s particularly well-suited for UK businesses due to its strong compliance features for VAT and Making Tax Digital (MTD) rules. It helps businesses stay on top of their tax obligations with ease.

The software allows for customizable invoices, automatic payment reminders, and detailed financial reports. QuickBooks Online provides different tiers to suit various business sizes and needs, from sole traders to larger SMEs. Many small businesses find its comprehensive features invaluable.

4. Sage Business Cloud Accounting

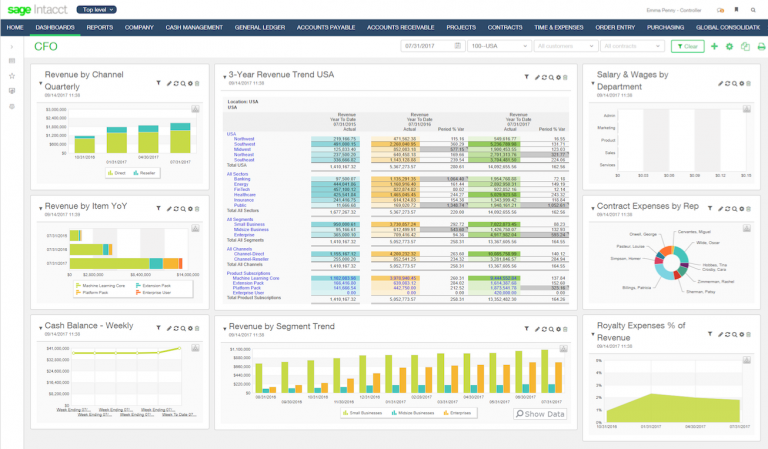

Sage is a long-standing name in accounting, and its Business Cloud Accounting platform is a strong contender for UK small businesses. It provides powerful invoicing capabilities, including custom quotes and invoices, multi-currency support, and payment tracking. Sage is known for its reliability and strong support.

The platform helps businesses manage cash flow, expenses, and even payroll. Its clear, intuitive interface simplifies complex financial tasks, making it a solid choice for those who need a trusted solution. You can find more details on UK tax obligations on the official HMRC website.

5. FreeAgent

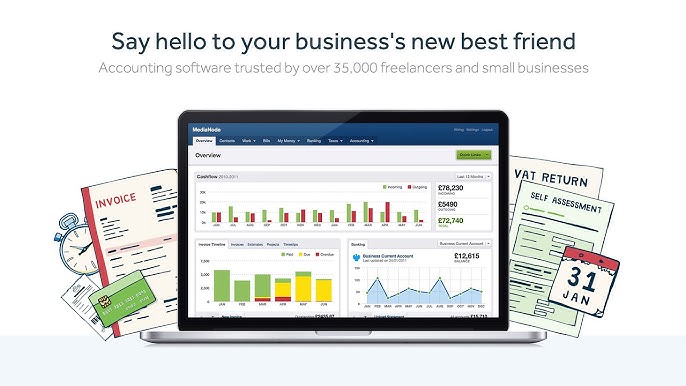

FreeAgent is specifically designed for UK freelancers and small businesses. It offers a straightforward approach to invoicing, expense tracking, and self-assessment tax. Its unique selling point is its focus on simplifying accounting for non-accountants, making it very approachable.

It provides clear insights into your finances and helps prepare you for tax season. FreeAgent also integrates with popular banking platforms and payment gateways, streamlining your financial workflow. For an example of how business tools can simplify complex areas, consider exploring information on company income tax.

Choosing the Right Invoicing Software for Your Business

Selecting the best invoicing software for your UK small business depends on several factors. Consider your budget, the number of invoices you send, whether you need multi-currency support, and if you require integration with other tools like your bank or e-commerce platform.

Many providers offer free trials, allowing you to test features before committing. Look for software that scales with your business, offers excellent customer support, and most importantly, makes your financial life easier. A good resource for comparing business tools is often found on platforms like Capterra or G2.

Conclusion

Efficient invoicing is vital for the health and growth of any small business in the UK. The right software can transform your financial processes, ensuring you get paid on time, maintain accurate records, and stay compliant with regulations. Tools like Cordlo, Xero, and QuickBooks Online offer robust features tailored to small businesses.

We encourage you to explore the options and choose a platform that aligns with your specific needs. By investing in quality invoicing software, you’re not just buying a tool; you’re buying peace of mind and more time to focus on what you do best: growing your business.